Most traders don’t lose because they can’t read charts.

They lose because they trade every signal in every condition.

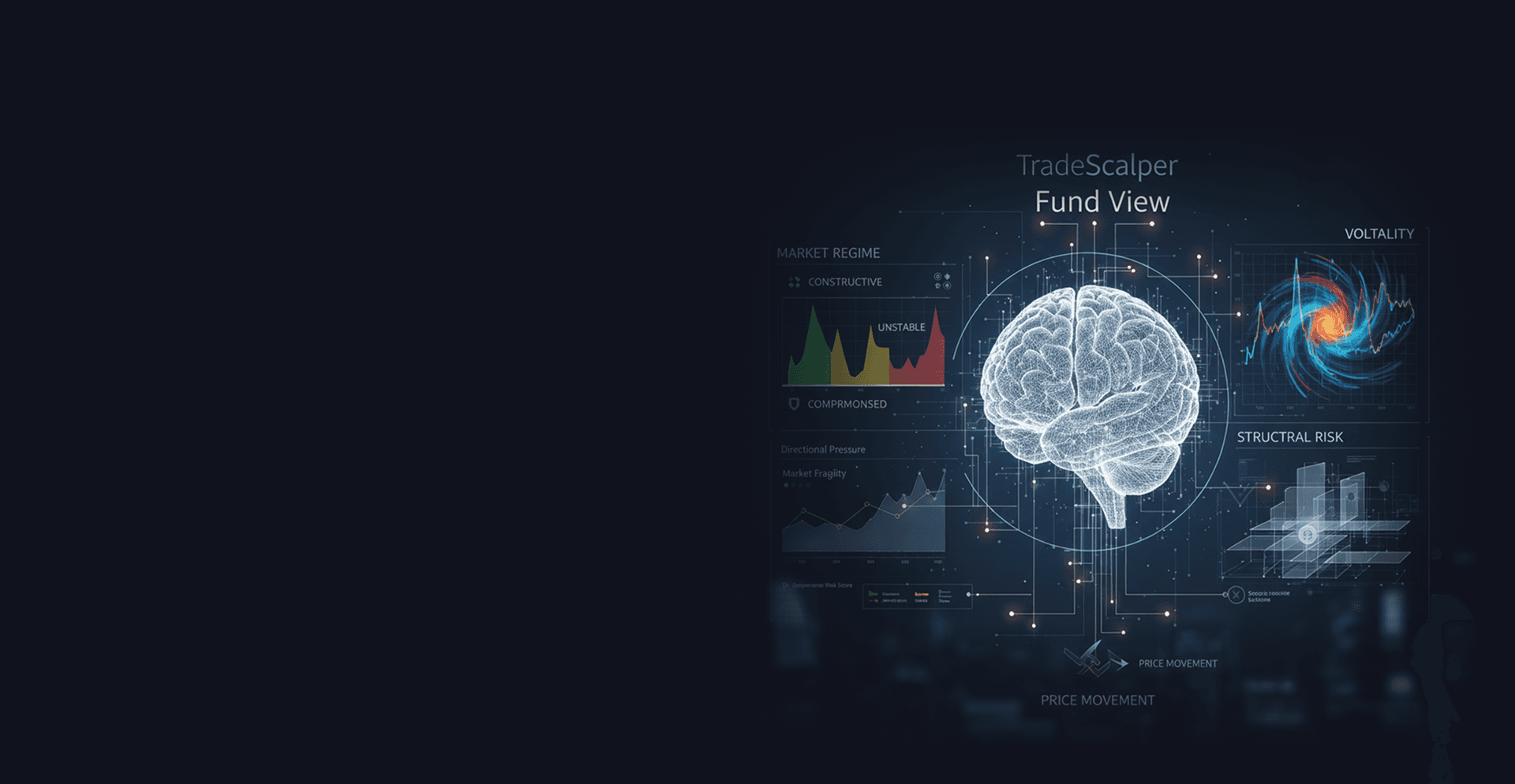

Fund View shows you when the market is supportive, when it’s hostile, and when staying out is the smartest trade.

Most losses don’t come from bad trades.

They come from bad timing, poor risk controls, and inconsistent trading behavior.

Most retail traders don’t fail because they lack skill.

They fail because they’re active when the market is hostile.

Chop, low participation, volatility spikes, and false breakouts punish even the best-looking setups.

That’s when overtrading starts — and small losses turn into damage.

Fund View helps you recognize those conditions before you consider placing a trade.

Environmental Intelligence

What price alone never tells you

Who Fund View is Built For

For traders who want consistency — not excitement.

This is for you if:

This is NOT for:

Framework. You don’t trade price.

You trade conditions.

Fund View doesn’t predict markets.

It diagnoses them.

That’s the difference between reacting to price — and operating inside an environment.